Simplifying Multi-Provider Payment Management with Orchestration

Global businesses need a smart payment orchestration solution to optimize costs, reduce risks, and support local preferences.

Managing payments across multiple providers is one of the most complex challenges for businesses operating in the global digital economy. From navigating diverse regional preferences to mitigating risks and optimizing costs, the complexities can quickly become overwhelming.

This is where payment orchestration emerges as a powerful solution, streamlining multi-provider payment management while maximizing efficiency and cost savings. The Payment Orchestration market reached USD 1.77 bn in 2024, projected to grow at a CAGR of 23.2% to USD 9.39 bn by 2032.

The Need for Payment Orchestration in Multi-Provider Environments

As businesses aim to expand globally, they encounter a wide range of challenges that a single PSP often cannot address effectively. This is where payment orchestration becomes indispensable. It addresses critical needs such as:

Regional Preferences: Catering to diverse local payment methods and currencies in different markets.

Risk Mitigation: Spreading risk across multiple providers to prevent single points of failure and enhance security.

Cost Optimization: Leveraging competitive pricing and intelligent routing to minimize transaction fees.

Operational Complexity: Reducing the burden of managing numerous individual integrations and workflows.

At its core, payment orchestration unifies the fragmented landscape of payment gateways, processors, and methods into a streamlined system. This integration enables businesses to automate transaction routing, optimize costs, and provide a consistent user experience. By acting as a centralized platform, payment orchestration simplifies complex payment workflows, offering enhanced transparency, efficiency, and control for merchants.

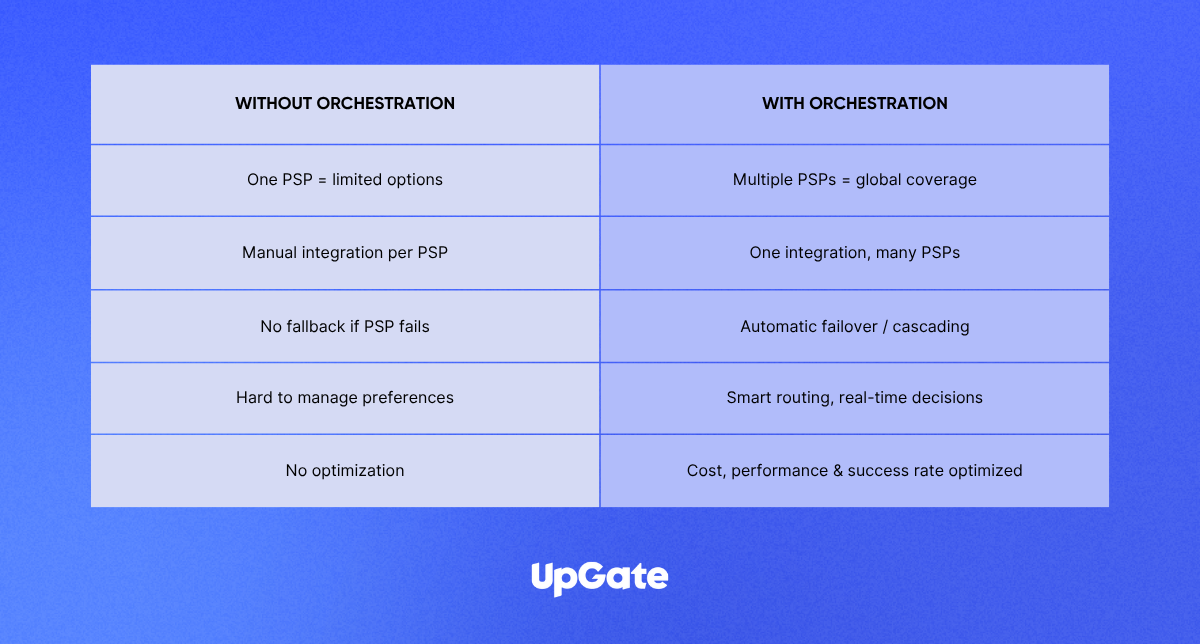

Challenges in a Multi-PSP Setup Without Orchestration:

Without an orchestration layer, businesses often face:

Complex Integrations: Each new PSP requires a separate, often custom, integration, leading to significant development time and resources.

Operational Inefficiency: Managing disparate systems results in manual processes, data silos, and a lack of unified reporting.

Lack of Control: Limited visibility and control over transaction routing and performance across different providers.

Higher Costs: Inability to dynamically route transactions to the most cost-effective provider, leading to increased fees.

Downtime Risks: A single PSP outage can bring payment processing to a halt, impacting sales and customer satisfaction.

Key Benefits of Using PSPs via Orchestration:

Payment orchestration transforms these challenges into opportunities, providing a cohesive, agile, and robust payment infrastructure.

Want to know more about how we can help your business go global? Book a demo: upgate.com/demo